Many people purchase term life insurance to help protect their families when their children are young and dependent on them for support. By definition, term policies have ending dates, and it’s not unusual to allow a term policy to lapse without obtaining replacement coverage after children leave home and can support themselves.

Even if you do not need life insurance to replace lost income for your dependents, you may want insurance for other purposes, such as paying final expenses or leaving a legacy. For these needs, you might consider a survivorship life insurance policy.

A Cost-Effective Approach

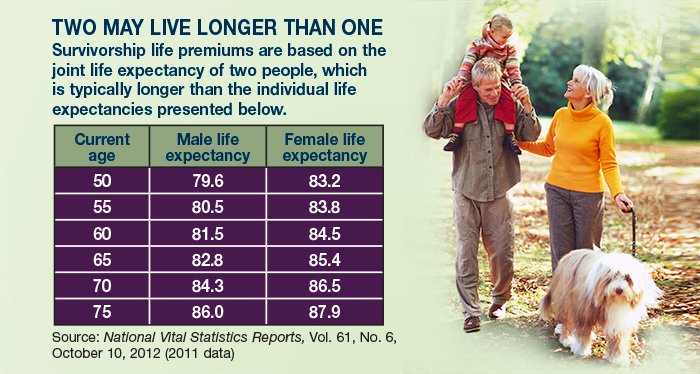

Also called second-to-die insurance, a survivorship life insurance policy insures two people and pays a benefit after the death of the second insured person. The premiums are usually less expensive than premiums for a single-life policy because they are based on the life expectancies of both insured individuals. This can be especially helpful later in life, when an individual life insurance policy may be more expensive or difficult to obtain. Survivorship policies can also be used to insure business partners, and options may be available to insure more than two people, if appropriate.

Survivorship life insurance is often used to pay estate taxes, which typically do not become an issue until estate assets pass to nonspouse heirs. Fewer estates may be subject to federal estate taxes now that the higher exemption amount ($5.25 million in 2013) has been made permanent by the American Taxpayer Relief Act of 2012. However, heirs often face other expenses in settling an estate, including probate and state estate taxes, which typically have lower exemption levels than federal estate taxes. The death benefit from a survivorship life insurance policy can help pay these expenses without requiring heirs to sell assets or dip into their inheritances.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable.