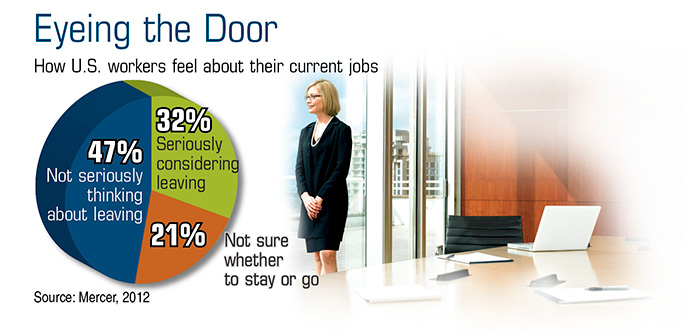

Despite the high national unemployment rate, a hiring survey reveals that there are often shortages of qualified candidates to fill positions in certain fields. Engineers, IT experts, and executives (or top managers) are all on the list of professionals with sought-after skill sets. In addition, 60% of employers expect voluntary employee turnover to increase as the economy and job market continue to improve.¹

Thus, it could prove difficult and expensive for businesses to replace experienced workers who decide to leave. By some estimates, replacing managerial and professional employees could cost as much as 150% to 200% of their annual salaries.²

Here’s how an executive bonus plan funded with cash-value life insurance could possibly be used to reward and help retain your most valuable employees.

Incentive to Stay

Business owners may appreciate that an executive bonus plan is typically easier to adopt and more flexible than some other types of employee benefits. The premiums are paid by the business with bonuses that are tax deductible to the employer but taxable to the employees. The company determines the amount of each bonus and when to pay it, so the timing of the expense can be controlled.

A bonus plan may also be designed with certain restrictions and vesting requirements that make the life insurance policy more valuable for an employee who remains with the company.

The employee owns the policy and also bears the responsibility to keep it in force. He or she can borrow against, and sometimes withdraw from, the cash value if needed for emergencies, to pay college tuition, to help fund retirement, or for any purpose. If the policy is in force at the time of death, the employee’s named beneficiaries will receive the death benefit, minus any outstanding loans, free of income taxes.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that the individuals for whom you are purchasing the policies are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications.

1) Mercer, 2012

2) Wharton School of the University of Pennsylvania, 2012