Markets regained steam last week, pushed higher by a reassuring Federal Reserve meeting and a referendum on Scottish independence. For the week, the S&P 500 gained 1.25%, the Dow grew 1.72%, reaching a new record, and the Nasdaq rose 0.27%.1

FEDERAL RESERVE ACTION & THE US DOLLAR

As was generally expected, the Federal Reserve voted to continue to taper its quantitative easing programs by another $10 billion per month.2 Digging a little deeper, meeting notes suggest that though the Fed believes the economy is still growing at a moderate pace, economists are still concerned about meager labor participation and growing income inequality. The official statement of the Fed’s meeting shed little light on the timeline for interest rate changes, but Dallas Fed President Richard Fisher stated that the Fed should start raising rates in spring 2015, not summer, as many analysts have predicted.3 It’s too soon to know how markets will react to a sooner-than-expected interest rate increase, especially since economic conditions between now and then may change.

The U.S. dollar has been on a tear over the last couple of months, making this the longest winning streak since 1973, and the return of a strong dollar has its share of winners and losers.4 A rising dollar helps fight inflation by making each dollar buy more in goods and services; it also makes it cheaper for Americans to buy imported goods. Since consumer spending makes up about 70% of economic activity, when consumers pocket extra money, it’s generally a win for the economy. On the other hand, a stronger dollar is hard on exporters of U.S. goods, and multinationals who depend on foreign demand are being hit with a one-two punch of stagnant demand from major trading partners in Europe and Asia plus a rising dollar, which further cuts into their sales.

So, is a rising dollar ultimately good for the U.S. economy? In the short run, it’ll probably be a net positive, since consumers are benefiting and will be able to spend more money. The long-term effects won’t be known for some time; but, generally speaking, as long as currency movements remain stable, financial markets should be able to adapt.5

The week ahead is packed with speeches by Fed insiders, which analysts will be mining for additional details after the Fed’s official statement last week. With the end of the quarter upon us, investors are also starting to turn their attention to earnings, mid-term elections, and positioning their portfolios for the end of the year. Could we still see a correction? Absolutely. While the equity environment is looking healthy and the economy is doing well, a deteriorating economic situation in Europe and China or geopolitical issues in Ukraine or the Middle East could definitely throw a wrench into the works.

PERSONAL NOTE

I am sure you have noticed that I quote Dr. Wayne Dyer frequently. He has been a mentor to me and I have been reading his books for approximately 25 years. I really love his overall message. It is a message that primarily focuses on strategies for living from a higher place.

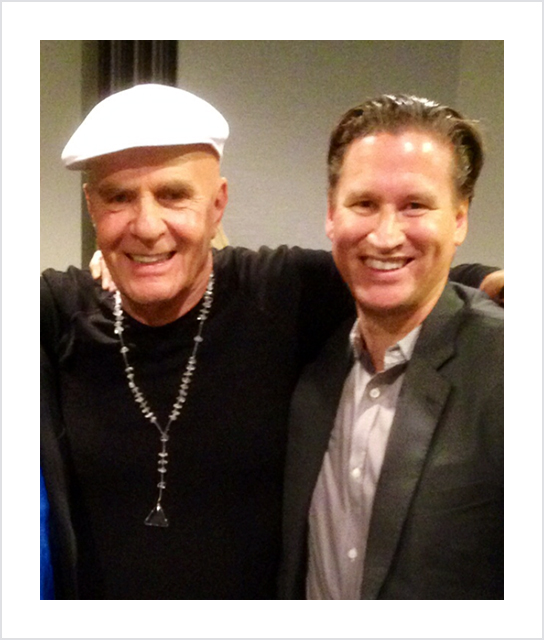

I was fortunate to have spent time with Dr. Dyer this past weekend when I took him to see Pippin! He loved the show and could not believe what the actors, turned acrobats actually do; all without a net underneath to catch them.

After the show, I brought Dr. Dyer backstage to meet the cast. There was an amazing exchange of energy. Dr. Dyer loved meeting the cast members. He felt he had connected with the cast through the story of Pippin and his pursuits. Likewise, the cast loved meeting Dr. Dyer and speaking with him. Many of the cast members even asked for his autograph. His daughter told me that her father could not stop talking about the entire evening. It was very special for him.

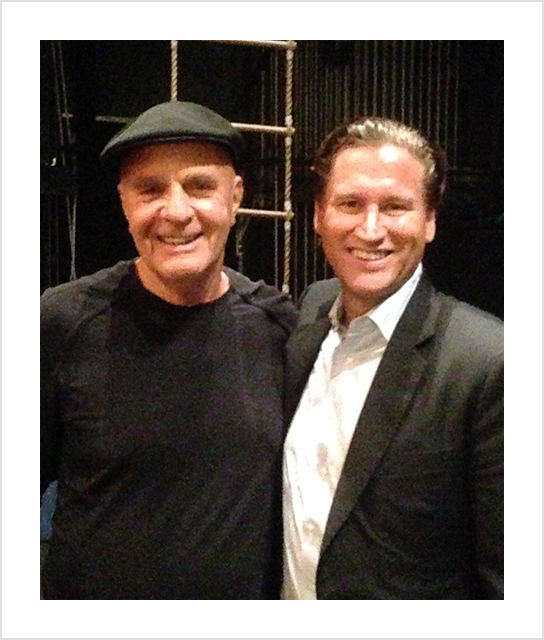

The following day, I was invited to be his guest at his lecture at the Javits center. I sat in the front row and was “blown away” by what he said. I have been to approximately 15 of his lectures. This time it was truly different because I felt I had a “personal connection” to him like he did to the Pippin cast.

In his lecture Dr. Dyer mentioned and reflected on Pippin a couple of times. More specifically, he felt that the story line of “living a life that is extra ordinary” applies to all of us.

At the end of the lecture, I met up with him again in his “lunch room.” He was so gracious. I told him that I was leaving for Philadelphia with my wife Trish, for the Mid-Atlantic Emmy’s because I had been nominated for two Emmy Awards for a show that I serve as an executive producer called Due Process that airs on PBS.

We won an Emmy Saturday night and the entire Due Process team dedicated the Emmy to Dr. Wayne Dyer for the relentless work he does on PBS. It is a weekend I will never forget and wanted to share with all of you.

“There is a voice in the Universe urging us to remember our purpose for being on this great Earth. This is the voice of inspiration, which is within each and every one of us.”

Dr. Wayne Dyer

1 http://goo.gl/7e8iCs, http://www.usatoday.com/story/money/markets/2014/09/18/stocks-thursday/15819291/

2 http://www.cnbc.com/id/102009413

3 http://www.reuters.com/article/2014/09/19/us-usa-fed-fisher-idUSKBN0HE1NW20140919

4 http://www.reuters.com/article/2014/09/19/usa-stocks-weekahead-idUSL1N0RK1W120140919

5 http://www.reuters.com/article/2014/09/19/usa-stocks-weekahead-idUSL1N0RK1W120140919