Get started

Ever wonder how much money you will need to retire?

Fill out our patented GPS questionnaire. Your information such as assets, ongoing contributions, and savings will allow us to create a tailored projection that will help you and your family prepare for the perfect retirement.

Get your GPS projection

A 2019 study showed that 64% of people don’t believe they have enough money for retirement, and with unexpected events occurring more frequently, you can use our unique GPS projection to ensure you and your family are prepared for the future.

From your GPS projection we can quickly determine if your situation will or will not work for you based on your desired retirement age. The projection will show the financial roadmap of your retirement all the way into your 90’s.

Projection review call

We believe in a team approach here at Mahoney Asset Management. Being able to walk you through all the potential strategies to achieve your financial goals is important to us. During the review call with one of our experienced advisors, we will discuss your GPS Projection and how to best use it to ensure that you do not run out of money in retirement. We will also address other vital areas of your retirement plan that we need to address.

In-person meeting

During your first in-person meeting with one of our advisors, we’ll get to know each other more. This in-person approach allows us to begin to design the best strategy to help you achieve your retirement goals.

Regular monitoring of your portfolio to ensure that you’re on course

Our advisor and client service specialist teams will assist you with all investment allocations moving forward. We will keep you informed every step of the way with regular review meetings, projection updates, and market news from Ken. Ken’s sought-after thoughts, opinions, and investment philosophies greatly benefit all our clients. Let’s create your roadmap for the future, together.

The latest from Ken Mahoney

Catch up on Ken's TV appearances.

Book Offer

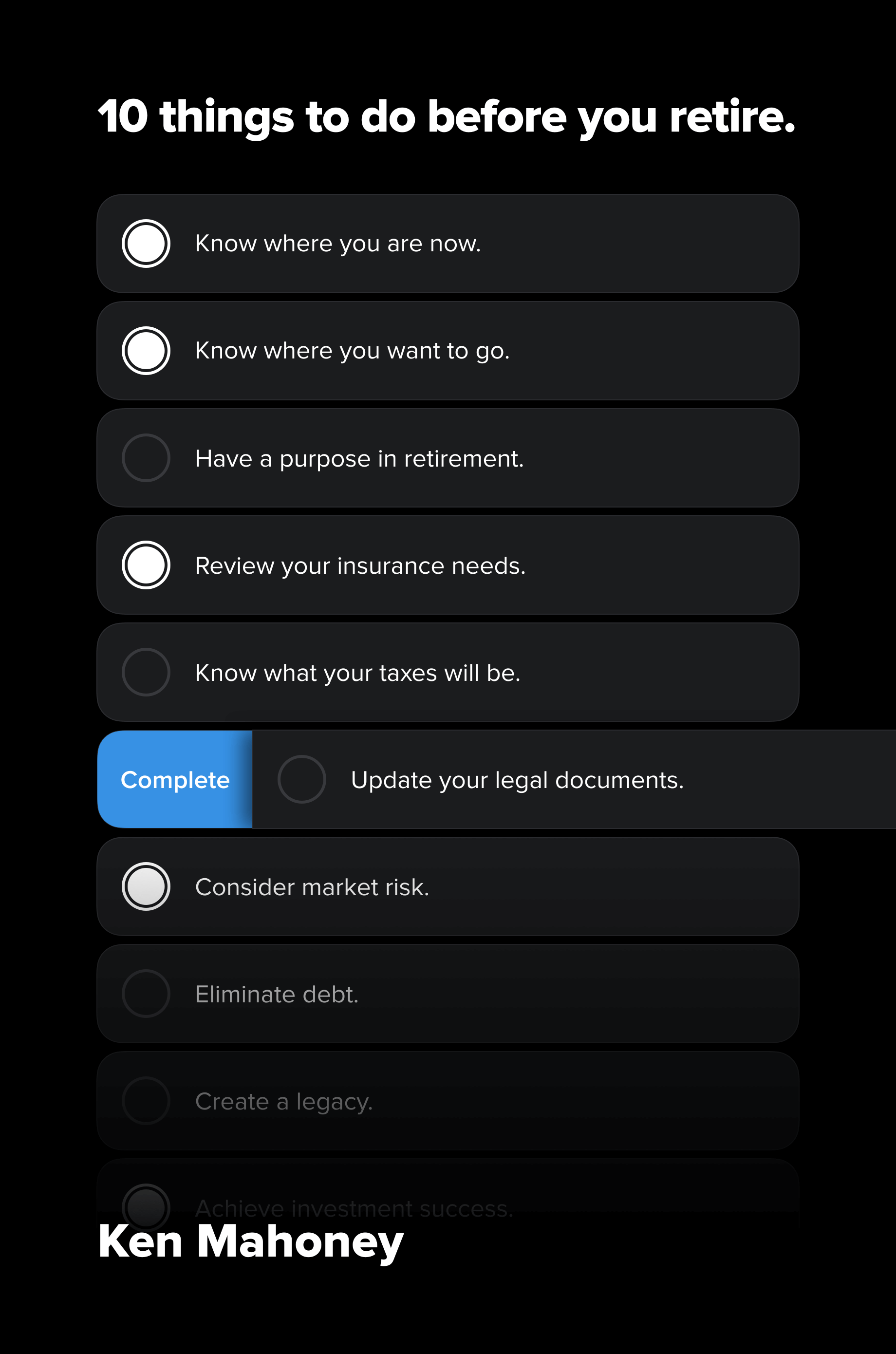

Get 10 Things To Do Before You Retire free.