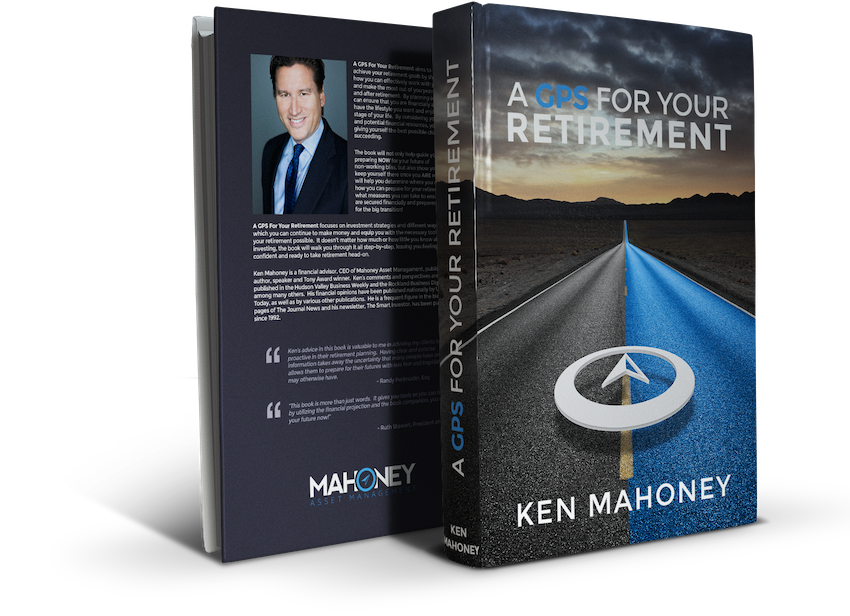

A GPS For Your Retirement

Chapter 1 – Mindset: The Power of Your Subconscious

While many other retirement books may start out with a chapter on why retirement is so important, and what you need to do to be prepared for yours, I’m going to start with what I consider the most basic tool of all: your mindset. Attitude, mindset and your mental state are all the first keys to your retirement success.

How many times have you heard that your attitude determines your altitude? It’s true! Now let’s start our ascent to 30,000 miles.

This is what I call the ‘psychology’ or mindset of retirement:

Your subconscious is a powerful tool that can be harnessed to help you achieve your life’s goals before and during retirement, to be successful and truly happy. It’s like a storeroom for everything not currently being used by your conscious mind, like your memories or your beliefs or skills you haven’t used in the last few years but you know you have. For example, when learning something new, it is nearly impossible to multi-task and focus on what you’re learning at the same time, but after a while, you can accomplish the task and do other things at the same time. It becomes your auto-pilot button and allows you to focus on other things after being programmed into your subconscious.

When you have a positive attitude, what you need to do becomes automatic as your conscious mind is no longer required. Your subconscious can be programmed just like a computer. But just like a computer, it has rules and ‘errors’ can still pop up so it’s best to know what those are, so that you can program your mind effectively.

No Differential between Visualization and Reality

Your subconscious mind cannot differentiate between what is real and what is fictional. It automatically believes something to be real regardless of whether you know it’s not. If you’ve watched a horror movie and paid attention to how you’ve reacted, you’d notice that you feel fear and your pulse races even though you are aware of the fact that you are not in any danger. This aspect can be used to one’s advantage because through repeated visualization, the subconscious can make anything you present it with real. Let’s think about what you need to do to get out of debt for a successful retirement; if you visualize success as becoming debt free, your subconscious will believe that there is no reason why you can’t get out of debt, and you will find yourself looking at the task positively, with a new sense of strength and confidence.

Time Moves Faster

When you do something fun, you realize that time always moves faster than when you’re doing something that you consider a job, a chore, or just something you really don’t enjoy doing. When you’re doing something you don’t actually want to do, you form the habit of looking at your watch or the clock and time seems to stand still. This is because your subconscious recognizes that you habitually look at your watch during this particular activity and why time never seems to move. The same can be said for when you’re asleep, you don’t notice time passing because it’s only your conscious mind that’s asleep. So when you’re trying to achieve your goals and you make it fun, time will pass by in a flash and the quicker you will reach them.

The Harder It Believes, The Harder It Is To Change

The more the subconscious mind believes something to be true, the harder it is to convince the subconscious that it isn’t. If you have a long withstanding belief or view about something, it can be harder to change it. For example, people losing weight believe that something isn’t tasty even though it’s good for them. The longer they’ve held that belief the harder it will become to try and change it so that they will eat the healthier foods. It’s very important to look ahead at your retirement and believe that you can accomplish what it takes to retire successfully; and not just for a few years, but for the duration of your retirement. The more you cement the ideas of “I can” and “I will” the more you will find that rather than dreading the thought of retirement and all that comes with it, you are actually happily anticipating the day and eager to get there as soon as possible.

Every Thought Causes a Physical Reaction

If you think that you’re going to do poorly in something, then you are going to do poorly. The thought has been embedded into the subconscious and therefore the physical reaction is that you don’t focus on the task or activity. However, if you think something like, ‘I’m going to run and lose weight,’ then when you run, you’ll lose weight because your mind is turning that thought into a physical reaction. Your subconscious mind will do everything in it’s power to make that thought come true.

“

Change the way you look at things and the things you look at change.

Dr. Wayne Dyer (famous quote)

Setting goals is very important when it comes to your retirement and I’ll be talking about that a little later on—it’s important to have something to achieve, to see yourself in the place you want to be at in the future. Without goals, you have no reason to work hard to achieve anything and you will find yourself struggling to retire.

Everyone has goals throughout their lives, things they want to achieve in their careers, their personal lives and their retirements; you just have to look deep into yourself and find out what yours are.

Proof Strengthens Your Beliefs

If you believe yourself to be fat and someone says that you are, it just further cements into your mind that you are fat. However, if you believe that you are healthy, that you are beautiful and fit, all you have to do is find proof from those who care about you to cement that you are indeed those things.

Even you can cement them by saying out loud that you are those things and it becomes proof enough for your subconscious to be believed. It’s important to believe in yourself, in your capabilities and strengths.

People who are in debt struggle to get out of it when they have a negative attitude. Staying positive on your journey towards retirement and after is crucial.

Subconscious Wins against Conscious

No matter what, your subconscious mind will win in an argument against your conscious mind. If you have a fear and even though you consciously believe you have nothing to be afraid of and you come in contact with that fear, your subconscious mind will win out. Because the subconscious mind is more powerful than the conscious one, it’s important to train the subconscious to win against any unworthy conscious thoughts.

Thinking ahead about your retirement with dread or unease will make it harder for you to succeed.

New Ideas—Replacing the Old Ones

Once a new idea has been accepted by the subconscious mind, the old idea has been replaced. Say you think that lettuce is rabbit food. If you replace that idea with the fact that a salad is a great way to get vitamins and stay healthy and you accept that fact as truth, you will no longer think lettuce is rabbit food.

Avoid Conscious Effort

The more you try to obtain something with your conscious mind, the less your subconscious will respond. If you will yourself to consciously sleep, you won’t sleep because it involves conscious effort. Your subconscious should be doing everything for you and the more you try to seize control with your conscious mind, the less likely it is to happen.

This may sound like ‘mind games’, but even Olympic athletes use visualization techniques to help them achieve their goals. I want you to have a “Gold Medal” in retirement and use this ‘secret’ to retirement fulfillment.

Suggestions Can Program the Subconscious

Basically, the subconscious mind will accept anything you tell it providing that the conscious mind isn’t present at the time. The key behind hypnosis is that you can implant a suggestion inside a person’s mind, like ‘You hate smoking’, and their subconscious mind will believe it providing that the conscious mind isn’t present at the time the suggestion is made.

Now that you understand the rules behind this vital resource, you can manipulate it to work towards helping you achieve your goals. Just because a goal seems impossible to grasp, doesn’t mean it is impossible.

The reason why I am ‘dwelling’ on this concept is that we have old tapes that are on continuous play about money.

And if they were positive thoughts about money, we would continue to let the tapes play.

However, for most of us, we have negative subconscious beliefs/tapes that play:

“Money doesn’t grow on trees”

“Money is the root of all evil”

“I can never have enough money”

“I may outlive my money”

“What if I go broke”

So on, and so on.

None of the above ‘tapes’ will help you feel good about money.

Get the rest of the book.

A GPS For Your Retirement will help you navigate your way to and through retirement, mentally and financially. It aims to help you achieve your retirement goals by showing you how to effectively work with your assets and make the most of retirement.

© Mahoney Asset Management

INVESTING RISK DISCLOSURE

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money. Before investing, consider the funds’ investment objectives, risks, charges, and expenses. Contact Mahoney Asset Management for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

IMPORTANT CONSUMER INFORMATION

This web site has been prepared solely for informational purposes. It is not an offer to buy or sell any security; nor is it a solicitation of an offer to buy or sell any security.This site and the opinions and information therein are based on sources which we believe to be dependable, but we can not guarantee the accuracy of such information.

Representatives of a broker-dealer or investment adviser may only conduct business in a state if the representatives and the broker-dealer or investment adviser they represent: (a) satisfy the qualification requirements of, and are approved to do business by, the state; or (b) are excluded or exempted from the state’s licenser requirements.

An investor may obtain information concerning a broker-dealer, an investment advisor, or a representative of a broker-dealer or an investment advisor, including their licenser status and disciplinary history, by contacting the investor’s state securities law administrator.

SECURITIES: ARE NOT FDIC-INSURED/ARE NOT BANK-GUARANTEED/MAY LOSE VALUE

This information is intended for use only by residents of CA, CT, DC, FL,, MA, MD, MN, NC, NJ, NY, OH, PA, and VA. Securities-related services may not be provided to individuals residing in any state not listed above.

The financial calculator results shown represent analysis and estimates based on the assumptions you have provided, but they do not reflect all relevant elements of your personal situation. The actual effects of your financial decisions may vary significantly from these estimates–so these estimates should not be regarded as predictions, advice, or recommendations. Mahoney Asset Managment does not provide legal or tax advice. Be sure to consult with your own tax and legal advisors before taking any action that would have tax consequences.

Office of Supervisory Jurisdiction

1200 North Federal Highway, Suite 400

Boca Raton, FL 33432

Toll-Free: 877-447-9625

Phone: 954-334-3450

Fax: 954-489-2390