The Week on Wall Street

Stock prices pushed higher last week, as investors remained hyper-focused on any new developments with the U.S. trade negotiations with China.

The Dow Jones Industrial Average picked up 0.91%, while the Standard & Poor’s 500 rose 0.62%. The Nasdaq Composite index gained 0.93% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 2.28%.

Trade Winds

For nearly two years, investors’ moods have seemed to swing with each twist in the ongoing trade saga between the U.S. and China. Last week was no different.

On Tuesday, stock prices fell sharply on concerns that U.S.-China trade tensions had escalated. The White House announced the addition of 28 new Chinese companies to its list of firms that are banned from doing business in the U.S. Later in the day, White House officials confirmed that they had implemented travel bans on selected Chinese officials.

But prices bounced back Thursday and surged higher Friday on White House reports that suggested the trade talks between the two countries were “going really well.” Near the close Friday, the White House confirmed that the U.S. has come to a “very substantial phase one deal” with China.

Quarterly Earnings

Investors may start to get a better glimpse into third-quarter earnings this week, as more than 150 companies are expected to report on their operations.

As “earnings season” get underway, some attention may shift from the U.S.-China trade negotiations and toward company reports.

What’s Next

Some U.S. financial markets will be open, and some will be closed, on Monday, October 14, in observance of the federal holiday Columbus Day. The U.S. bonds markets and most banks will be closed. But the New York Stock Exchange and the NASDAQ will be open for regular hours.

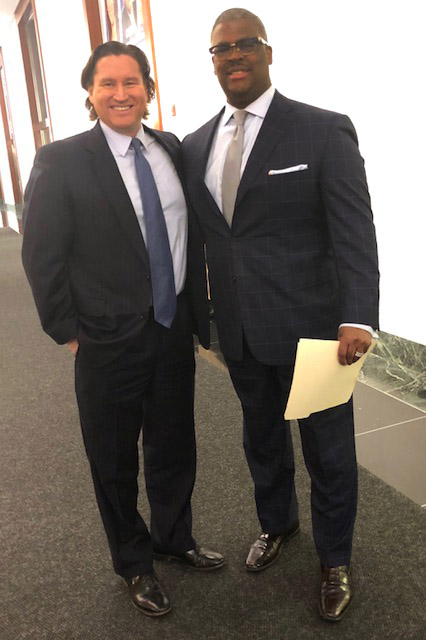

Ken was on Fox Business on Friday, sharing his thoughts on

‘Making Money in a Volatile Market’

Catch Ken this Thursday, on ‘Making Money with Charles Payne, in the 2:00 pm hour

Here is Ken’s notes from his last TV appearance:

The market has tunnel vision when it comes to China. It seems that is all that matters at the moment. With the Fed cutting rates, earnings season about to ‘kick in’ these events are not on the markets radar, they seem to be somewhere in the ‘twilight zone’

We have discussed here and with our clients for a long time that we believe we get a ‘partial fill ‘ on Narravro’s ‘7’ must haves for a Trade deal. Although we all would like to see that we believe it will not happen at one time.

A win at this time would be not raising any more tariffs, while they still look for a bigger deal. We feel that a full comprehensive deal, if it were to happen, would come after the election.

At this point both China and the President, would both want to walk away with a ‘win’ as both have issues they are dealing with, Trumps impeachment battle and China’s Hong Kong problem.

The market has obviously been choppy very reactive around the deal is close to ‘done’, to ‘no deal’. yet investors can benefit from this choppiness. When we get oversold, pick up some ETF’s. When we get overbought, to sell into rallies. These conditions have been around for some time now and we believe it will continue for some time.

The bears have the headlines, yet don’t seem to be able to do much thats sustainable with it. There seems to be a persistent bid under the mkt, perhaps that is because of buyback, or the perceived put by the Fed as interest rates are at historically low levels.

Earnings coming up should perhaps keep the bears guessing as with every earnings season, there will be ‘hits and misses’.

We have also been watching the credit markets, especially the high yield market, where there is also has been persistent bid!