Sign in for Premium Content

If you are a client, sign in below to access premium content.

Stocks rebounded during the holiday-shortened week as gains in overseas stock markets spurred buying activity, giving the Dow its best week since March. Despite the buying pressure, investors curbed their enthusiasm ahead of the Federal Reserve meeting next week. For the week, the S&P 500 gained 2.07%, the Dow grew 2.05%, and the NASDAQ gained 2.96%.1

I mentioned last week on RTL Europe (Europe’s largest TV network), that the market will be going through a ‘bottoming process’ for some time. As much as we would like the Dow to recover back to 18,000 quickly, a lot of ‘technical damage has been done.

I also mentioned to the network, that China is slowing down; it is also a proxy for world demand. Since 2010, China has been the largest manufacturer in the world (ousting the US). It is why that when China ‘sneezes’, the rest of the world catches a cold.

China’s Growth Sputters

Fresh data out of China showed that factory output missed expectations, supporting the view that China’s economic growth may dip below 7% for the first time since the global recession. Infrastructure investment also fell, leading many experts to believe that China’s central government may be forced to roll out new measures to boost economic growth.2

All Eyes on the Fed

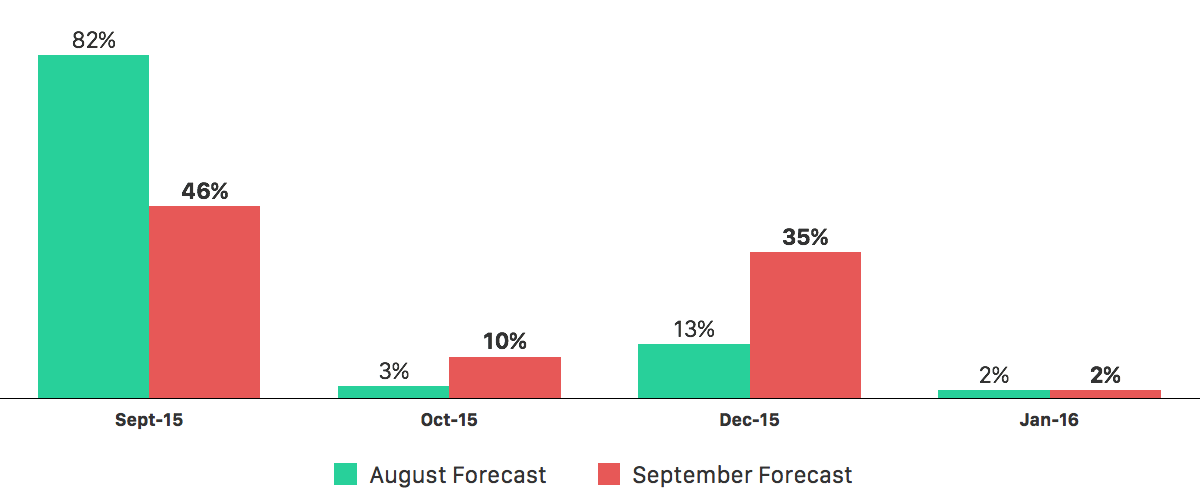

This week, the eyes of the world will be on the Federal Reserve as the Open Market Committee votes on whether to raise interest rates for the first time in nearly a decade. The FOMC meets Wednesday and Thursday and will issue their official statement Thursday afternoon. The most recent Wall Street Journal survey of private economists shows that experts are split. Last month, a whopping 82% of economists thought that the Fed would pull the trigger this week; now, just 46% think the Fed will act this month.3

Wall Street Journal Survey of Economists

{ Source: Wall Street Journal Economic Forecasting Survey. August & September 2015 Editions }

There are strong arguments to make on both sides of the issues. On the pro-rate-hike side are the opinions that too much easy money may fuel asset bubbles. Near-zero-rates also leave the Fed without ammunition in the event of another downturn.

On the hold-rates-steady side is the opinion that recent market volatility and ongoing concerns about global economic growth could spark another spate of selling if the Fed moves to raise rates now.4

Realistically, if the Fed moves this week to raise rates, they will likely announce a quarter-point raise to target interest rates in the 0.25%-0.50% range. How will markets react to a rate decision? It’s hard to say. Investors might view an increase as a vote of confidence in the economy and rally. Alternately, sentiment might sour on fears of a new economic downturn. As always, we’re keeping an eye on the situation and will update you as necessary.