Stocks rallied again last week on better-than-expected earnings and some reassuring news about China’s economy, giving the Dow its best weekly performance since mid-March.1 For the week, the S&P 500 gained 1.62%, the Dow added 1.82%, and the NASDAQ grew 1.80%.2

If you are a client, sign in below to access exclusive content.

Earnings reports are trickling in and the news so far is not as bad as expected. Since advance estimates had prepared investors for very weak earnings reports, the weak reports we’re seeing so far are being treated as victories. Out of 35 S&P 500 firms reporting in so far, total earnings are down 9.0% from Q1 2015 on 0.1% higher revenues with 71.4% beating their earnings estimates.3 As earnings season continues to unfold in the weeks ahead, we may see more of the same, which could give markets room to rally. On the other hand, investors could take the weak earnings picture as a sign that the economy is struggling to produce sustainable growth.

After months of gloom on China’s economy, a new report shows that China’s economy grew 6.7% in the first quarter. Though this is down from the fourth quarter’s 6.8% rate of growth, it’s not as bad as investors had feared. U.S. investors treated the news as a win, though China experts are skeptical about the reliability of these statistics. Since China’s ruling body has staked its political legitimacy on economic stability, officials have a lot of pressure to produce reassuring data. Overall, it’s not likely that China’s economic woes are over.4

The European Union gave us some headlines at the end of the week as Britain officially launched a campaign ahead of a referendum on leaving the EU on June 23rd. Current polls on a “Brexit” are evenly split with a significant number of people undecided on the issue.5 However, if Britain were to exit the EU, it would likely have a serious knock-on effect on markets, trade agreements, and currencies.6

In other international news, several major oil-producing nations met over the weekend to discuss coordinating oil output to stabilize prices. If they come to an agreement, oil prices might bounce higher and offer some relief to the beleaguered energy sector; however, closing a deal between a large group of producers with widely varying national interests will be tough.7

The week ahead is packed with earnings reports from 101 S&P 500 companies, including heavy hitters like Caterpillar [CAT], General Electric [GE], General Motors [GM], and Yum Brands [YUM].8 Investors will also get a look at housing market data and see how well the sector is doing during the spring real estate season

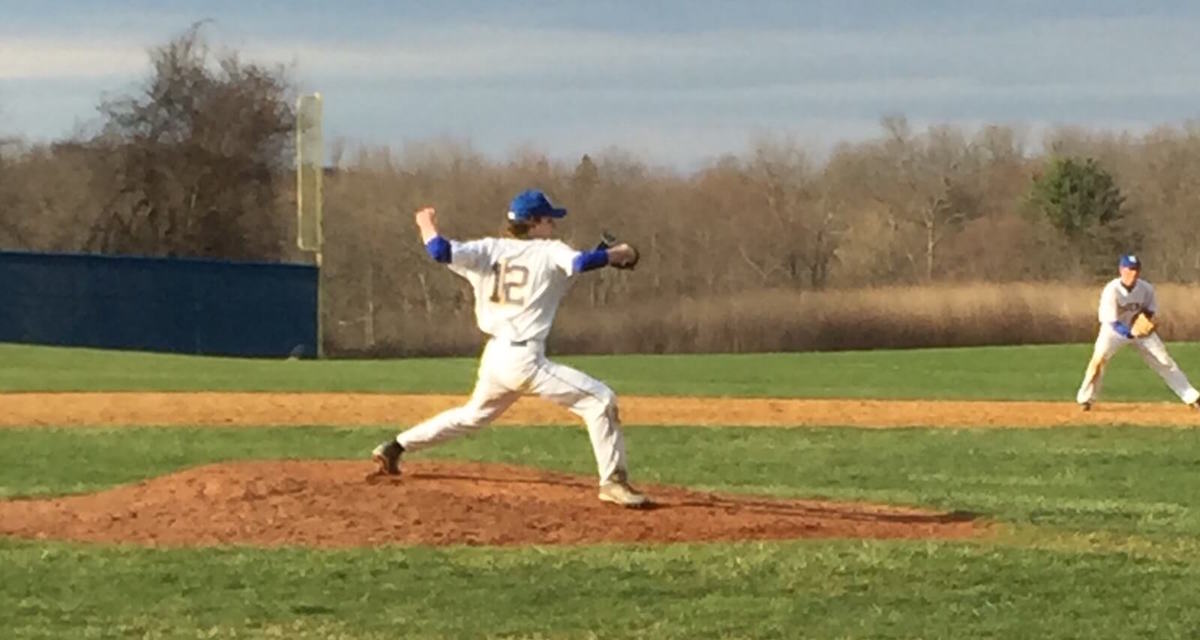

I know I spoke to many of you about my son Connor’s pitching. He recently pitched a complete game one hitter against a rival that is a Class A team

Read the article >