The S&P 500 and Dow ended last week slightly lower, but the NASDAQ posted an eighth straight week of gains for the first time since 2010.1 For the week, the S&P 500 lost 0.01%, the Dow fell 0.13%, the NASDAQ gained 0.10%, and the MSCI EAFE lost 0.64%.2

What is the Fed thinking? Minutes from the July Federal Reserve Open Market Committee meeting showed that officials are split about the economic outlook and when to raise interest rates. Hawkish rhetoric from Fed members who favor a rate hike soon could push the central bank into raising rates as early as September. More dovish officials aren’t convinced that tepid inflation will rise to the Fed’s 2.0% objective and favor a wait-and-see approach to raising interest rates.3

After several months of strong labor market gains, some economists think the economy is close to full employment and central bankers should move soon to put on the brakes by raising interest rates. If the economy gets overheated, prices could rise too much and push the economy into a boom/bust cycle that federal officials are anxious to avoid.

While a few years of outsized growth might sound nice after the years of slow expansion we’ve experienced, the economic hangover that might follow wouldn’t be pleasant at all. That’s why central banks like the Fed act to smooth out these economic cycles by lowering interest rates when times are tough (boosting investment through cheap credit) and raising them when growth picks up again (curbing excessive optimism by making credit more expensive).

The timing of rate increases is tricky, and the macroeconomic relationships that govern these decisions are complex and open to interpretation. Hence why some of the best economists in the world can’t agree on when to pull the trigger.

Which group will win out at the Fed? Since the Fed has been reluctant to jump the gun on interest rates, we don’t see a rate hike coming next month. However, the Fed might decide to surprise us.

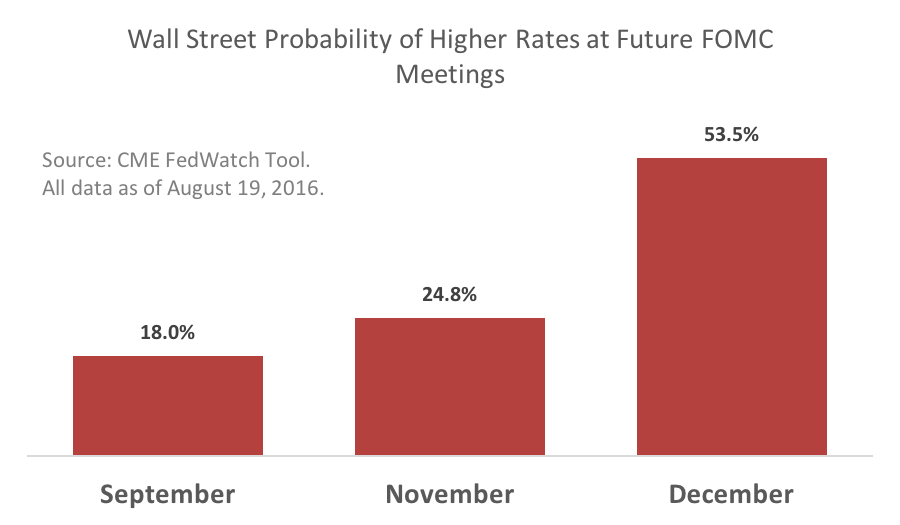

Currently, Wall Street traders judge the odds of a September hike at just 18.0%. However, traders think the Fed is likely to raise interest rates in 2016, judging by December’s rate probabilities.4 Will the Fed move soon? We’ll keep you informed.

This week is packed with economic data that will show us how the housing and manufacturing sectors are doing. We’ll also get a second look at second-quarter economic growth in Friday’s Gross Domestic Product report. Stay tuned for next week’s update.

I was on CNBC last Wednesday, and we spoke about ‘What did we learn about the Fed minutes?’

I mentioned on CNBC, that these are the ‘dog days of summer’, characterized by low volatility and low volume. I mentioned that a ‘sea change’ may be approaching and for investors to get ready for some increased volatility.