The 2006 film Failure to Launch told a humorous story of an adult son who couldn’t seem to leave his parents’ home. Although the plot was fictional, this scenario has become more common in real life — about three in 10 Americans aged 25 to 34 either live with their parents or have done so in recent years.¹

This trend is largely due to the job market, which has been especially tough on young workers. In mid-2012, the unemployment rate for young people aged 18 to 29 was 12%, about 50% higher than the national average.²

Smaller Household, Bigger Bank Account

The good news is that adult children typically find jobs, move out, and support themselves. When this happens, parents may suddenly have more disposable income.

After years of holding off on spending, some empty-nesters may splurge on themselves. One study found that parents whose children left home increased their per-person consumption of nondurable goods (such as vacations, restaurant dinners, and leisure activities) by 51% compared with people who never had children.³

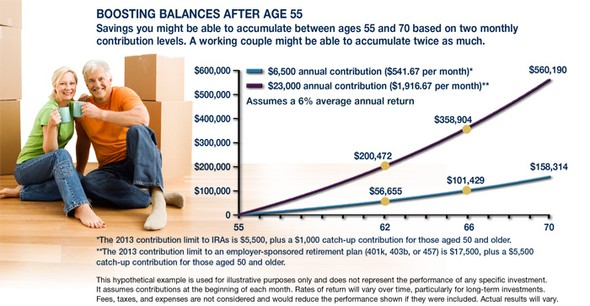

There’s nothing wrong with treating yourself, but increasing your consumer spending later in life could create lifestyle expectations that may be too expensive to maintain in retirement. It might be wise to dedicate at least some of the extra income to your retirement savings. You may be surprised by how much of a difference late-career contributions could make (see graph).

Here are two additional financial strategies to consider when your children leave the nest.

Move to a smaller home

If appropriate for your situation, you might consider making the move to a smaller home now and investing your home equity. National home values have appreciated at an average rate of 3.3% annually over the past 30 years.4 By contrast, a portfolio of 60% stocks and 40% bonds has returned an average of 10.5% annually over the same period, according to investment research firm Morningstar.5

Of course, the housing market varies significantly by region. All investments are subject to market fluctuation, risk, and loss of principal. Investments, when sold, may be worth more or less than their original cost.

Examine your insurance coverage

Auto insurance coverage is typically based on the location where a car is garaged (with some exceptions for college students), so if your children no longer live at home, you may save money by removing them from your policy.

The Affordable Care Act allows children to remain covered under their parents’ health insurance plans up to age 26 unless the child has access to health insurance through his or her own employment. Some plans extend dependent coverage up to age 26 regardless of employment, so you may want to investigate your options. Keep in mind that insurance companies often charge the same premium for family coverage regardless of how many children are covered under the policy.

An empty nest may seem like uncharted territory. It might be a good time to take a deep breath and make sure you have a clear financial strategy for the next stage in your life.

1, 3–5) CNNMoney, October 10, 2012

2) Forbes.com, July 26, 2012