One common rule of thumb in developing a retirement savings strategy is that your accumulated savings and other sources of income will need to replace about 80% of your pre-retirement income.¹

This assumes that retirees may be able to maintain their standard of living with less income because their taxes could be lower, there would be no need for retirement salary deferrals, their mortgages may be paid off before or soon after they retire, and they would no longer have work-related expenses such as commuting and business clothing.2

Replacement Variables

Although an 80% income replacement ratio is a reasonable goal, it does not indicate how much you need to accumulate and what to expect from other income sources. That could depend on several factors.

- Career earnings. If you have had high earnings over your career, Social Security may replace a lower proportion of your pre-retirement income. For example, a 65-year-old who retired in 2012 with a lifetime of “high” annual earnings (equivalent to about $68,800 in 2011) could expect Social Security to replace only 34% of his or her pre-retirement salary, compared with 41% for someone with a lifetime of “medium” earnings (about $43,000 in 2011).3

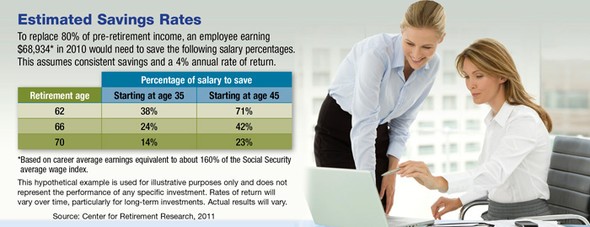

- Rates of return. Higher investment returns might result in a higher income stream, but this also involves a higher degree of risk. Rates of return will vary over time, so it might be a good idea to use a moderate return rate for your long-term projections.

- Age when you begin saving. The earlier you start, the less you may need to save out of each paycheck because compounding should enhance your overall savings accumulation.

- Age of retirement. The earlier you retire, the less time you may have to accumulate savings and the longer your retirement might last. This generally means that you will need to increase your savings rate while you are working.

Salary Multiples

Another approach is to think in terms of saving a multiple of your final pre-retirement salary. One analysis that factored in inflation and post-retirement medical costs suggested that employees would need to accumulate assets equal to 11 times their final salaries to meet their retirement needs (beyond the income they would receive from Social Security).4

However, a study of more than 2 million employees discovered that workers who saved for retirement throughout their careers were on track to accumulate 8.8 times their final salaries (on average), resulting in a shortfall of 2.2 times salary.5 Yet the same study found that if workers increased their contributions by 1% of salary each year for five years, the number of people who could retire with sufficient assets would increase from 29% to 46%.6 For someone earning $70,000 annually, a 1% increase equates to saving less than $3 each workday.7

Of course, the amount you need to save for retirement will also depend on other variables such as your lifestyle, your post-retirement medical expenses, the length of your retirement, and your supplementary sources of income. The key is to develop a solid strategy and maintain a steady pace toward your savings goal.

1–2) Center for Retirement Research, 2011

3) National Academy of Social Insurance, 2012

4–6) Aon Hewitt, 2012

7) $70,000 x .01 = $700 ÷ 250 workdays = $2.80