According to the U.S. Energy Information Administration (EIA), natural gas production is up 27% since 2006, reaching its highest level since record keeping began in 1973.¹

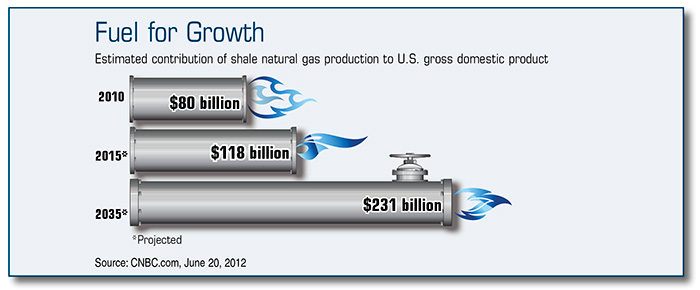

New technologies are allowing the energy industry to access shale deposits of natural gas in many parts of the United States. Consequently, an abundance of affordable natural gas is prompting changes in a number of industries, which could have a positive effect on U.S. economic growth in the years ahead.

Plentiful Resource

Vast reserves of natural gas are newly accessible through a technique called hydraulic fracturing, or “fracking.” A pressurized mixture of water, sand, and chemicals is used to extract the gas from shale rock layers as deep as a mile or more below the Earth’s surface.

Although it was generally assumed that the nation was running out of recoverable natural gas, many now believe that fracking could help supply U.S. consumers for more than 100 years (at current demand levels).² A surplus of natural gas has caused U.S. prices to fall more than 80% from highs reached in the previous decade.³

Concerns have been raised about the safety of fracking processes and how they might affect air and water quality. The Environmental Protection Agency and scientific groups are currently studying the potential effects of new drilling and extraction methods, but each state has the authority to regulate its own oil and gas industries. The U.S. Bureau of Land Management is working to finalize rules for fracking on federal lands such as national forests.4

Feeding Industry

Natural gas is a raw material in many chemical products including paint, plastics, and fertilizer, and it can also be used to heat homes, power engines, and generate electricity.

Compressed natural gas can be used to fuel vehicles. As a result, lower costs could benefit businesses in any industry for which fuel is a major expense — shipping, trucking, construction, and waste management, to name a few.

To take advantage of cheaper and cleaner natural gas, some utility companies are converting or building power plants to replace polluting coal-fired plants.5 It’s estimated that less expensive natural gas helped reduce consumer electricity costs by 10% in 2012.6 Moreover, the EIA has forecast that natural gas prices will remain low and that residential electricity costs will fall 2.2% in 2013.7

All types of manufacturers need energy to operate factories. Therefore, a stable, affordable fuel supply could make it cost-effective for more companies to build or expand production facilities and potentially hire more workers in the United States.

Weighing Exports

The Obama administration is also expected to set new policies pertaining to the exportation of liquified natural gas (LNG) in 2013. A government study concluded that permitting LNG exports would be beneficial to the U.S. economy, but some opponents believe that shipping U.S. supplies overseas could raise prices and hurt domestic industries that rely heavily on energy.8

Most human activities, whether undertaken for business or pleasure, now require reliable power sources. Thus, innovative technologies, government policies, and global market forces are likely to continue to influence U.S. energy trends and the overall economy.

1, 4–5, 7) USA Today, December 30, 2012

2, 6) CNBC.com, June 20, 2012

3) SmartMoney.com, July 11, 2012

8) The Wall Street Journal, December 6, 2012