Stocks ended a fourth straight week of gains, sending the S&P 500 index to another record high.1 For the week, the S&P 500 gained 0.61%, the Dow grew 0.29%, the NASDAQ added 1.40%, and the MSCI EAFE closed flat.2

Second-quarter earnings season is in full swing, and the picture thus far is much like that of the last four quarters: uninspiring performance eked out on very little revenue growth. However, there are some encouraging signs that could presage better performance in the months to come.

As of July 22nd, we have data from 126 S&P 500 companies, accounting for almost one-third of the index’s total capitalization. Overall Q2 earnings for these companies are down 1.1% from the second quarter of last year on 2.6% lower revenues. However, over 70% have managed to beat earnings estimates, indicating that managers did a good job of setting the bar low.3 There are also plenty of revenue surprises from firms that saw more demand than expected.

Though it’s disappointing to see another quarter of negative growth, the picture for U.S. firms appears to be improving. Revenue growth is tracking above what we saw from this same group in the first quarter. That’s a sign that demand is better than it was earlier this year.

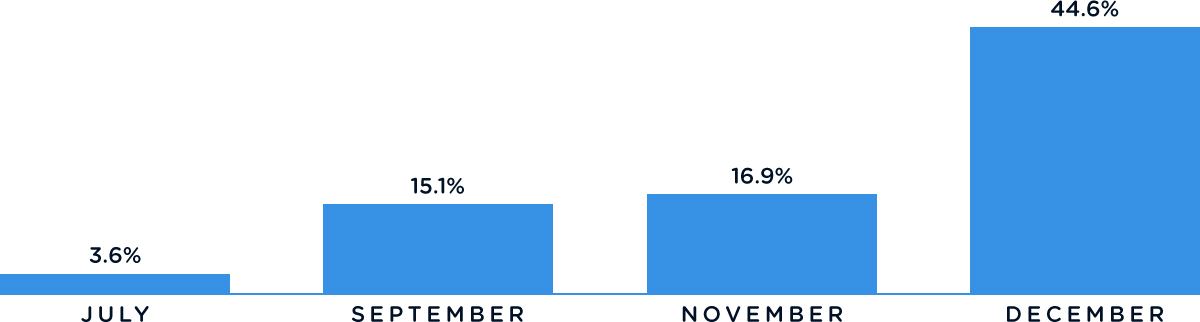

When Will the Federal Reserve Raise Interest Rates?

Source: CME Fedwatch Tool as of 7/22/16

In the week ahead

All eyes will turn to the Federal Reserve’s Open Market Committee Meeting to see what guidance the central bank will issue. Though virtually no one on Wall Street expects the Fed to raise interest rates at this meeting, many analysts believe strong domestic data will give the Fed the confidence it needs to raise rates before the end of the year. Traders will be watching closely to see whether the Fed strengthens the language in its statement to prepare markets for a future hike. The week ahead is also a decisive one for earnings, with nearly 1,000 companies reporting, including 189 S&P 500 firms.4