Gross domestic product (GDP) grew by a relatively stagnant 1.8% in 2011, ranking the United States 157th among the world’s countries. At the top of the list was Mongolia, with GDP growth of 17.5%, driven largely by a mining boom. Larger economies with strong growth rates included China (9.2%), Saudi Arabia (7.1%), and India (6.8%).¹

Of course, it might not be prudent to move a substantial portion of your assets from the United States to Mongolia, but these figures illustrate that there could be potential growth opportunities outside U.S. borders. One way to pursue these opportunities is through mutual funds that invest in foreign securities.

A Wide World of Choices

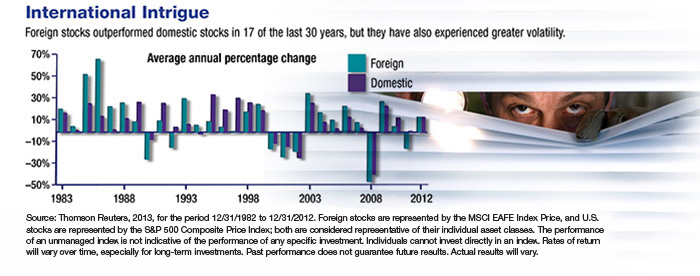

International mutual funds range from global funds that attempt to capture worldwide economic activity to regional funds and those that focus on a single country. Because foreign markets tend to perform differently than domestic markets, international funds can be a useful way to help diversify your portfolio (see chart). Diversification is a method used to help manage investment risk; it does not guarantee against investment loss.

Although all investments are subject to market volatility and loss of principal, investing internationally carries additional risks, such as differences in financial reporting and currency exchange risk as well as economic and political risk unique to the specific country. This may result in greater share price volatility.

Emerging economies may offer greater growth potential than advanced economies because they have further to go on the path toward economic development. In fact, the International Monetary Fund (IMF) projects an average growth rate of 5.6% for emerging economies in 2013 compared with 1.5% for advanced economies, which were held back by continuing struggles in the eurozone and Japan.² However, the stocks of companies located in emerging markets could be significantly more volatile and less liquid than the stocks of companies located in more developed foreign markets.

Countries transitioning from emerging to advanced economies often draw investor interest. The rapidly developing BRIC countries — Brazil, Russia, India, and China — have experienced impressive growth over the last decade but are beginning to slow down.³ The four Asian Tigers — Singapore, Hong Kong, Taiwan, and South Korea — have grown steadily since the 1960s and are now classified as advanced economies by the IMF.4–5

International investing requires time and effort to understand the potential risks and benefits, but it could be worthwhile to determine whether foreign securities are appropriate for your portfolio.

The return and principal value of all mutual funds fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) CIA World Factbook, 2012

2, 5) International Monetary Fund, 2012

3) Bloomberg Businessweek, June 26, 2012

4) Investopedia, 2013