Thirty-eight percent of Americans lack confidence that they will have enough income and assets for a comfortable retirement.¹ This may not be surprising for those in lower income tax brackets, but about one-fourth of investors with assets of $500,000 to $1 million (not including principal residence) — and more than one out of 10 millionaires — express similar concerns.²

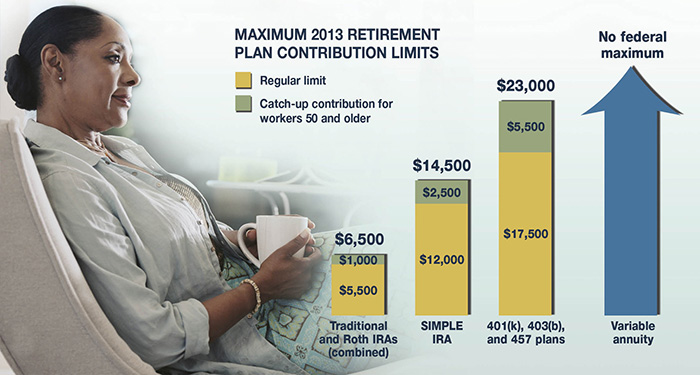

Fortunately, there are a variety of tax-advantaged vehicles to help you save for retirement, but many of them — including IRAs and employer-sponsored plans such as 401(k) plans — have annual contribution limits that may be too low to meet the needs of some savers. And, of course, not everyone is eligible to participate in an employer plan.

Beyond the IRA and 401(k)

One way to contribute more toward your retirement savings is through a variable annuity, an insurance-based contract that can be used to provide future income. Annuities may be funded with a lump sum or a series of premium payments. Although an annuity is typically purchased with after-tax dollars, any annuity earnings would be tax deferred until withdrawn, subject to certain limitations.

The annuity is considered variable because the contract value depends largely on the performance of the underlying investment “subaccounts.” You can choose to invest conservatively or aggressively based on your risk tolerance, long-term goals, and time horizon. Typically, you may select annuity payouts as a lifetime income, an income that lasts for a specific number of years, or an income that lasts for the lifetimes of two people.

A variable annuity is a long-term investment vehicle designed for retirement purposes. There are contract limitations, fees, and charges associated with variable annuities, which can include mortality and expense risk charges, sales and surrender charges, investment management fees, administrative fees, and charges for optional benefits. Withdrawals reduce annuity contract (living and death) benefits and values. Variable annuities are not guaranteed by the FDIC or any other government agency; they are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.

Withdrawals of annuity earnings, as well as distributions of contributions and earnings from traditional IRAs and most employer-sponsored plans, are taxed as ordinary income. Early withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty, with certain exceptions. Surrender charges may apply if the annuity is surrendered during the early years of the contract.

Any annuity guarantees are contingent on the claims-paying ability of the issuing company. The investment return and principal value of an investment option are not guaranteed. Because variable annuity subaccounts fluctuate with changes in market conditions, the principal may be worth more or less than the original amount invested when the annuity is surrendered.

Variable annuities are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the variable annuity contract and the underlying investment options, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1–2) Journal of Financial Planning, December 2012 and January 2013