The Week on Wall Street

Stocks descended from record highs Friday, as traders reacted to a U.S. drone strike that killed Iran’s top military officer. Oil prices rose more than 3% following the breaking news.1

Wall Street benchmarks ended up having a sideways week, shortened by the New Year’s Day holiday. The Dow Jones Industrial Average lost 0.04% across four trading sessions; the S&P 500, 0.16%. In contrast, the Nasdaq Composite rose 0.16%. The MSCI EAFE index, benchmarking developed overseas stock markets, added 0.30%.2,3

Oil Takes Center Stage

WTI crude oil settled at $63.07 a barrel on the New York Mercantile Exchange Friday, down from an intraday peak of $64.09 (which was its highest price since April).

The commodity rallied Friday, as energy traders considered the possibility of supply disruptions in the Middle East in retaliation for last week’s U.S. air strike.4

Manufacturing Activity Deadlines

At the start of each month, economists watch the Institute for Supply Management’s Purchasing Managers Index for the factory sector, which is considered a key barometer of U.S. manufacturing health.

Last week, ISM announced a December reading of 47.2 for this index, the poorest in more than ten years. A reading below 50 indicates manufacturing activity is contracting rather than expanding.5

New book for 2020

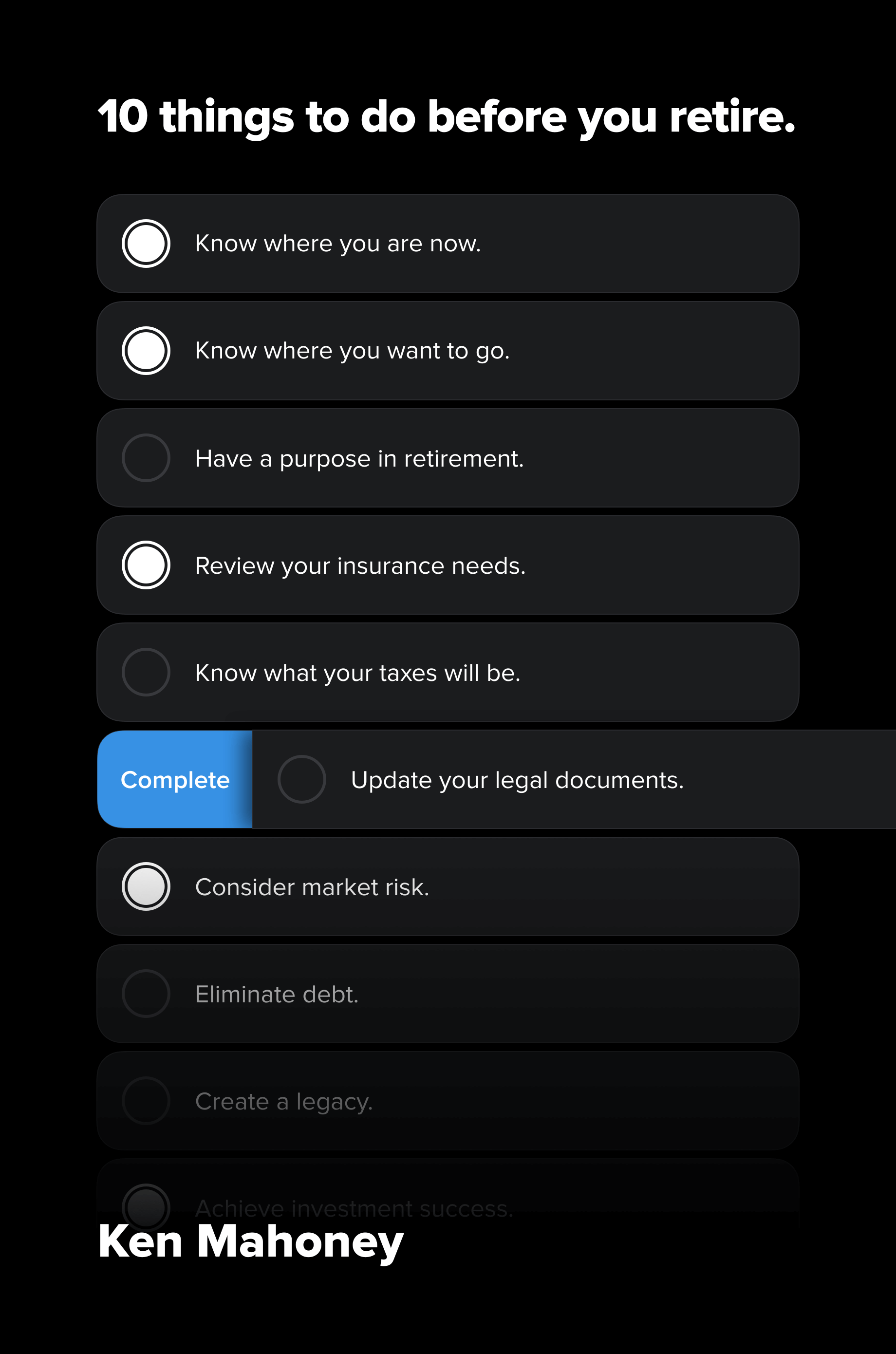

10 Things to do Before You Retire

This book is different than the other books I have written, because it’s meant to be an 'action guide'. The concepts that we cover in this book need to be addressed in order to have a fully engaged and purposeful retirement.

At the end of each chapter, you will find a checklist of action items you must do to prepare for retirement. At the end of the book you check off what you did, and you can see what is deficient. Successful retirement's does not happen by chance. Like any other long-term endeavor, it requires planning, forethought, and consideration of all possible scenarios and their consequences.

Talk to Gina to get your eBook. Get your eBook now