Despite the uncertainties of the job market, today’s workers stay in a job for an average of only 4.4 years. Job-hopping is even more prevalent among younger workers: about nine out of 10 millennials (born between 1977 and 1997) expect to stay in a job for less than three years.¹

The impact of moving from job to job on a worker’s career depends on individual circumstances. However, any time you leave a job — whether you’ve been there for three years or 30 years — you could be faced with a decision about what to do with the savings in your employer-sponsored retirement plan. There are typically four options.

Leave the savings in the account

If your employer allows you to retain the account, this strategy might make sense as long as fees are low and you are satisfied with the investment options. Keep in mind that you will no longer be able to contribute to the account, and it could be bothersome to receive multiple retirement account statements.

Transfer assets in a former employer’s plan to a new employer-sponsored retirement plan (if allowed)

This might be a better option than leaving assets in your former employer’s plan. Again, your decision may depend on the available investment options and expenses.

Roll the funds to an individual IRA

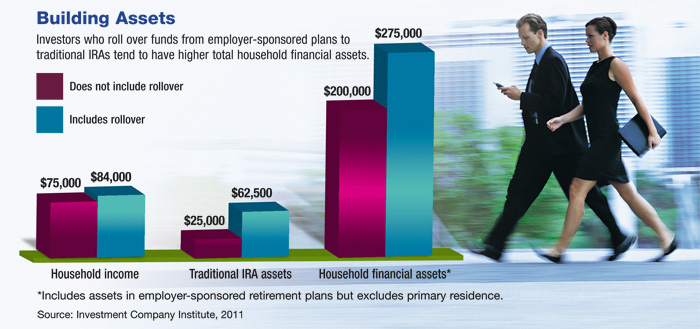

Moving your savings to your own IRA enables you to control the money, regardless of how many times you change jobs. It could also expand investment opportunities because IRAs typically have more investment options.

If you choose an IRA rollover, be sure it is executed properly if you want to preserve the tax-deferred status of the funds. You can generally do this through a direct rollover, also called a trustee-to-trustee transfer. You can arrange this by contacting the administrators of your old employer-sponsored account and your traditional IRA. There is no withholding, and the money never passes through your hands.

If you receive a check, you must roll the entire distribution (including 20% federal income tax withholding) to your IRA within 60 days or it will be considered a taxable distribution.

Withdraw the money

This is generally unwise because you would also lose out on potential tax-deferred growth that you might need for retirement. In one study, 55% of people who took distributions when changing jobs said they regretted the decision.² Distributions from employer-sponsored retirement plans and traditional IRAs are taxed as ordinary income and may be subject to a 10% federal income tax penalty if taken before age 59½ (with some exceptions).

Choosing what to do with the savings you have accumulated in your employer-sponsored plan can be complicated, and you may benefit from professional guidance. Although there is no assurance that working with a financial advisor will improve investment results, a professional who focuses on your overall objectives can help you consider options that could have a substantial effect on your long-term financial situation.

1) Forbes, August 14, 2012

2) AdvisorOne.com, January 26, 2012