There’s plenty of guidance available to help you feel confident that it’s time to retire. But it could be just as important to recognize signs that you may not be ready. You might think of these as yellow caution lights, warning you to slow down and give further thought to your situation.

You’ve reached the eligibility age for Social Security

For some people, Social Security eligibility is synonymous with retirement. In fact, about 50% of those who are eligible for benefits file at the earliest age of 62, despite the fact that their monthly payments will be permanently reduced.¹

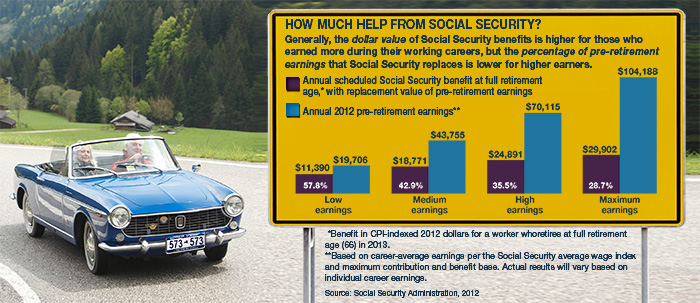

Even if you have reached full retirement age (age 66 for those born between 1943 and 1954), you may not be ready to retire unless you expect to receive substantial income from savings and/or other sources. Social Security is intended to replace only a portion of your pre-retirement income (see chart). Benefits increase at filing ages up to 70.

You need to work part-time

Sixty-five percent of older workers say they would like to continue working in some capacity during retirement.² That’s a worthwhile goal if you can do it by choice, but be careful if you expect to depend on part-time income. Jobs are not easy to find, and many part-time positions pay low wages. It might be wise to work in your current job a little longer to help build additional savings.

You’re counting on market growth

The rapid decline in stock values during the Great Recession and slow growth during the recovery suggest that it might not be wise to factor high returns into your retirement strategy. In fact, when you retire or are close to retirement, you may want to shift more of your assets to conservative investments. Doing so could help preserve principal but typically is associated with lower growth potential.

You’re not prepared for medical costs

In a recent poll, the high cost of medical care was retirees’ biggest surprise regarding retirement expenses.³ Even with current Medicare benefits, it’s estimated that a couple who retired in 2012 at age 65 would need $240,000 to pay their out-of-pocket medical expenses in retirement.4

Your spouse is not on board with your decision to retire

About three out of five married couples disagree on the timing of their retirements.5 Whether you decide to retire together or several years apart, it’s important for you and your spouse to be comfortable with the other’s choice to retire or continue working.

You have high debt or other financial obligations

Traditional formulas for determining retirement income needs often assume that retirees have paid off their mortgages. If you are still making payments on your home, have college loans or high credit-card debt, or are supporting your children or aging parents, you may not be ready to leave the workforce.

The road to retirement can have many twists and turns. A yellow light may be a timely warning that you are not quite ready to go full speed ahead.

1) SmartMoney.com, March 2, 2012

2) usnews.com, February 10, 2012

3) PRNewswire, July 11, 2012

4) NYTimes.com, May 9, 2012

5) WSJ.com, April 9, 2012