According to a 2013 survey, almost 90% of middle-income Americans do not feel prepared to handle the financial cost of a critical illness. Most respondents said they would have to use their savings, but 75% had less than $20,000 in savings and 25% had no savings at all.1

A critical illness can be especially challenging, but even healthy people with medical insurance can face substantial out-of-pocket expenses. The total health-care cost for a typical family of four covered by an employer-sponsored PPO insurance plan is $22,030 in 2013. More than 40% of this total — $9,144 — is paid by employees through payroll deductions and out-of-pocket expenditures.2

One strategy that may help reduce health-care costs while saving for future expenses is to combine a high-deductible health plan (HDHP) with a health savings account (HSA).

Trade-Off for Lower Premiums

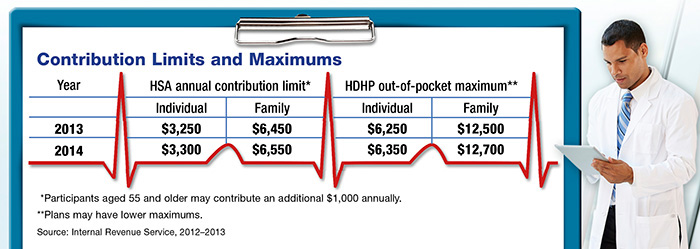

Individuals covered by an HDHP pay a relatively high annual deductible — at least $1,250 ($2,500 for families) in 2013 and 2014 — for services such as hospital care, physician visits, and prescriptions before the plan begins to pay a percentage of expenses. The costs for medical services may be reduced through the insurer’s negotiated rate, and certain types of preventive care, such as annual physicals and health screenings, may be provided at no cost. Some plans have higher deductibles.

The trade-off for potentially higher up-front expenses is that premiums are typically lower for HDHPs than they are for traditional PPO and HMO plans. To protect consumers from “catastrophic expenses,” HDHPs (and most other policies) are required to have out-of-pocket maximums above which the insurer pays all medical expenses.

Tax-Advantaged Savings

Only individuals who are enrolled in an HDHP are eligible to establish and contribute to an HSA, which is a tax-advantaged savings account that can be used to pay future medical expenses. HSA contributions are typically made through payroll deductions, but in most cases they can also be made directly to the HSA provider. (See the chart above for contribution limits.)

HSA funds can be withdrawn free of federal income tax and penalties as long as the money is spent on qualified health-care expenses. Depending on the state, HSA contributions and earnings may or may not be subject to state taxes.

Assets in an HSA belong to the contributor, so they can be retained in the account (typically with an investment option) even after the individual changes employers or retires. Unspent HSA balances can be used to help meet medical needs in future years, whether the account owner is enrolled in an HDHP or not. Although HSA funds cannot be used to pay regular health insurance premiums, they can be used to help pay Medicare premiums and long-term-care expenses.

The HDHP/HSA strategy is designed to help keep total medical costs down by encouraging consumers to focus on wellness, compare costs, and use in-network providers and generic prescription medicines. Although this requires some effort — and may not be appropriate for everyone — it could help you control your annual out-of-pocket expenses.

1) AdvisorOne, May 8, 2013

2) Milliman, 2013