The stock market has been on a wild ride since October 2007, when the Dow Jones Industrial Average and the S&P 500 index both hit record highs, only to lose more than 50% of their value over the next 15 months. It took over five years for both indexes to surpass their pre-recession levels, and they set new records in the spring of 2013.1–2

This type of volatility can be hard on an investor’s nerves. It also can be hard on portfolio value if an investor reacts emotionally when buying and selling investments. One method that may help you weather market volatility is dollar-cost averaging.

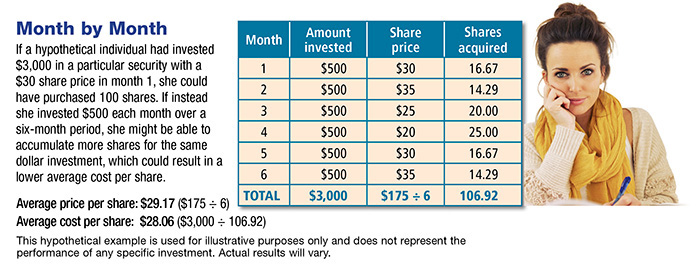

Dollar-cost averaging involves investing a fixed amount in a particular investment on a regular basis, regardless of market conditions. Theoretically, when the share price falls, you would purchase more shares for the same fixed investment. This may provide a greater opportunity to benefit when share prices rise and could result in a lower average cost per share (see chart).

Of course, dollar-cost averaging does not ensure a profit or prevent a loss. Such a strategy involves continuous investments in securities regardless of fluctuating prices. You should consider your financial ability to continue making purchases during periods of low and high price levels. However, this can be an effective way for investors to accumulate shares to help meet long-term goals.

All investments are subject to market fluctuation, risk, and loss of principal. When sold, they may be worth more or less than their original cost. The Dow and the S&P 500 are unmanaged groups of securities; the S&P 500 is considered to be representative of the U.S. stock market in general.

1–2) The Wall Street Journal, March 5 and 28, 2013