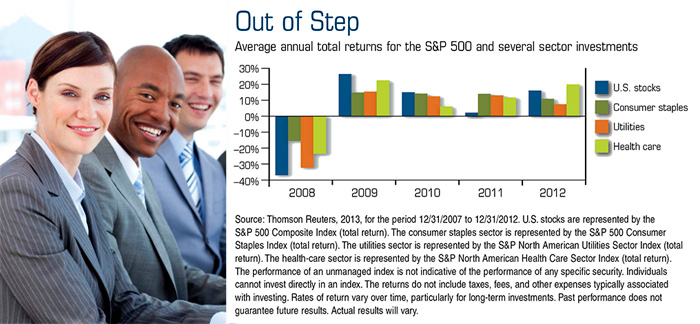

Individual sectors of the U.S. economy often behave differently at various points in the business cycle. Therefore, changes in the direction or speed of economic growth can spur shifts in equity market performance.

Some industries tend to lead the pack when the economy is experiencing steady or rapid growth, whereas others are more likely to outperform during periods of recession or recovery. For this reason, spreading investments among the major sectors is one way to help diversify stock market holdings.

Sector funds, however, should generally play a smaller and more targeted role than the broader-based equity funds that often serve as the centerpiece of investors’ mutual fund portfolios.

Narrowing the Field

A sector fund is a mutual fund with stock holdings that are concentrated in a specific sector such as health care, technology, utilities, and financials. Sector funds are available in different styles and can vary according to market capitalization (small, medium, or large companies) and investment objective (growth, value, or blend). Because sector funds are less diversified than mixed equity funds, they typically carry a significant level of volatility and risk.

The return and principal value of mutual funds fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Diversification and asset allocation are methods used to help manage investment risk; they do not guarantee against investment loss.

Strategic Uses

Sector funds can be selected to complement a core portfolio of diversified mutual funds, which can sometimes be over- or underweighted in one or more sectors. Investors may be able to fill market exposure gaps and strive for more precise sector allocations.

It may also be possible to moderate overall portfolio risk by investing in sectors that are historically less volatile or less economically sensitive than the stock market as a whole. Some types of sector investments may help mitigate market losses in troubled economic environments (such as inflation or recession).

Sector funds may be appropriate for some investors who are pursuing higher returns over time and can tolerate a higher level of risk. These investors should also have longer time horizons (5 to 10 years) so they can hold investments through the sector’s entire cyclical rise and fall.

Investors who “chase performance” and move assets into hot sectors may be too late to benefit from market gains and could suffer losses instead. In most cases, it is difficult to recognize turning points until after they have passed.

You may also want to keep in mind that every cycle is different from the last, and macroeconomic events or unexpected shocks can sometimes disrupt regular trends.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.