Many people file for Social Security as soon as they stop working and/or become eligible for benefits. Full retirement age is 66 for most baby boomers and 67 for those born in 1960 or later, but Americans can claim early worker benefits starting at age 62.

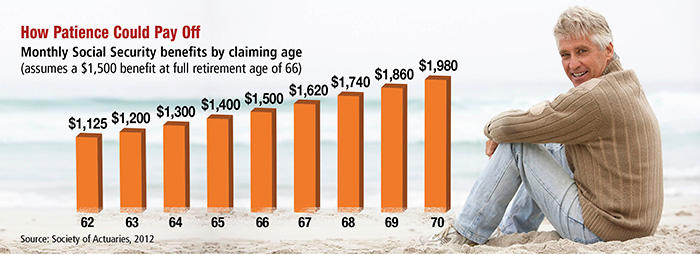

The monthly benefit increases with claiming age by up to 8% a year, so filing early could cause you to lose out on thousands of dollars in benefits, especially if you enjoy a long life.

Consider this hypothetical example: Paul could receive an annual benefit of about $15,400 if he files at age 62, $20,500 if he files at age 66 (full retirement age), or $27,100 if he waits until age 70. If Paul waits until age 70 to file for Social Security and lives to age 95, he could receive about $677,000 in cumulative benefits (in today’s dollars). This compares with roughly $500,000 if he files early at age 62.

If you are relatively healthy and have other savings to draw upon in retirement, it may be in your best interests to delay claiming benefits. Married couples may also be able to increase their total benefits by coordinating when and how they file for Social Security.

In general, you should weigh your financial resources, potential taxes, health, life expectancy, and other factors when making this important decision. For more information, visit the Social Security Administration website at

www.ssa.gov.

Source: CNNMoney, July 31, 2013