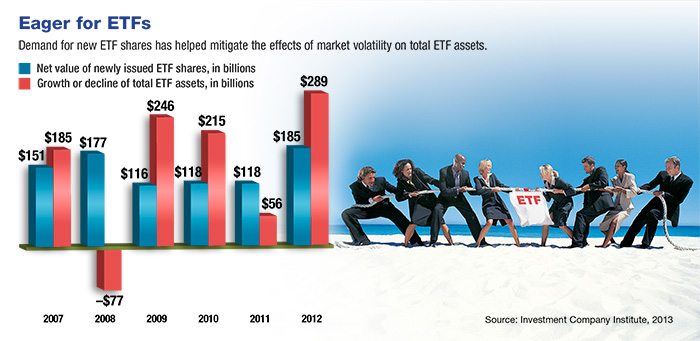

As demand for exchange-traded funds (ETFs) has grown, investors poured a net $185 billion into newly issued shares in 2012.1 The pace continued into 2013, with more than $80 billion net during the first five months, helping to push total ETF assets to a record $1.48 trillion, a 33% increase over the previous year.2

The appeal of ETFs may focus on their flexibility and relatively low costs. If you are interested in these funds, however, it’s important to understand how they work. Almost half of investors in a 2012 survey still consider themselves to be “novices” when it comes to ETFs.3

Mutual Funds Meet Stocks

When you invest in a mutual fund or an ETF, you are purchasing shares in a portfolio of securities assembled by an investment company, and as a shareholder you receive a portion of any dividends and capital gains generated by the fund. Both investments offer a variety of options — from stocks and bonds to various sectors — that enable you to carry out a diversification strategy. Of course, keep in mind that diversification does not guarantee against loss; it is a method used to help manage investment risk.

Typically, mutual fund shares are purchased from and sold back to the investment company, and the price is determined by the net asset value at the end of the trading day. By contrast, ETFs can be bought and sold throughout the trading day like individual stocks. Mutual funds are generally valued in direct relationship to their underlying assets, whereas supply and demand can make the share price of an ETF higher or lower than the value of the underlying securities.

Most ETFs are passively managed and track a particular index, which can make them more tax efficient than many mutual funds. However, there is a growing trend toward actively managed ETFs that assemble a specific mix of investments.4

Although ETFs often have lower expense ratios than mutual funds, you must pay a brokerage commission whenever you buy or sell shares of an ETF, which could increase your costs. In addition, the trading flexibility of ETFs could result in your trading more often than appropriate for your individual situation.

The principal value of exchange-traded funds and mutual funds will fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. As with any investment, it would be wise to consider the potential risks before making a decision to include ETFs in your portfolio.

Exchange-traded funds and mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1, 3) AdvisorOne.com, October 8, 2012

2, 4) Investment Company Institute, 2013