One might assume that most serious disabilities result from a sudden, unlucky accident. Surprisingly, 90% of all disability claims are for common health conditions such as cancer and back problems.¹

Disability insurance replaces a portion of lost income, up to policy limits, if a debilitating injury or chronic illness prevents a breadwinner from working. This type of protection can provide a lifeline for people who may otherwise be unable to support their families, but it can be just as critical for older and/or affluent workers during their peak earning years.

Because the benefits paid from an employer’s group plan, workers’ compensation, or Social Security probably won’t come close to replacing a six-figure income, well-paid professionals in the midst of productive careers generally have much to lose if they experience a disability and are unable to work. Individual disability income policies offer additional coverage and special features that can make them appropriate for highly compensated workers and professionals with special skills.

Benefit Basics

States may require employers to provide short-term disability coverage (or sick leave) for a few weeks or months, but only about one-third of American workers have access to long-term disability insurance through their employers.² Workers may want to purchase an individual disability income policy if they are self-employed or their employers do not offer coverage — or to supplement group coverage so that benefits may more closely match their current incomes.

Companies that offer long-term coverage typically provide policies that replace only 50% to 60% of base income (not including bonuses, commissions, or company contributions to retirement plans). In addition, monthly benefits are generally capped at $5,000 per month.³

If a disabled worker collects workers’ compensation or Social Security benefits, the employer’s plan may reduce the worker’s benefits by the same amount. Disability benefits are also taxable to the worker if the employer contributes to the premium. On the other hand, benefits from an individual policy (paid for by the policyholder) are generally tax-free.

Customizing Coverage

Some policies end payments when the disabled worker’s condition improves enough for him or her to perform any job, even if the salary is significantly less than what was earned before the disability. You might prefer to purchase an individual policy that will pay benefits if you cannot perform your “own occupation.” Residual coverage may help you replace lost income if you can only work part-time or at a lower-paying job after you return to work.

Other riders may allow you to add coverage without additional underwriting as your income increases, to extend the policy period past age 65 (to your expected retirement age), or to convert your policy to a long-term-care policy after you reach a certain age.

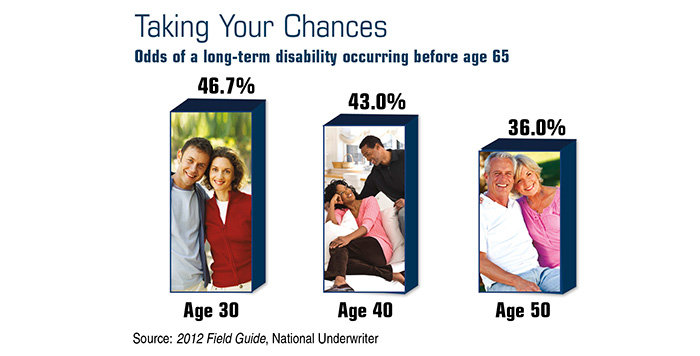

The potential for health problems tends to become a larger concern for workers aged 50 and older. An individual disability policy that has been tailored to suit your personal situation could help preserve your income, assets, and lifestyle.

1–2) Fortune, July 12, 2012

3) Bloomberg Businessweek, July 25, 2012