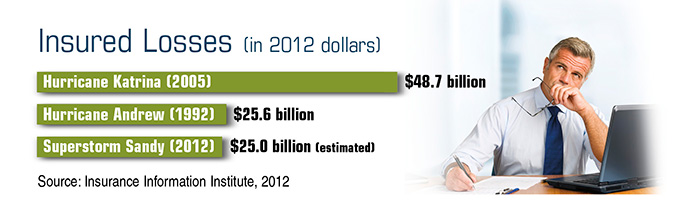

Superstorm Sandy wreaked havoc along the East Coast in 2012, leaving behind an estimated $50 billion to $60 billion in insured and uninsured economic losses. It’s likely that more than 150,000 insurance claims were ultimately paid to business owners.¹

Small businesses often operate on tight margins, so they can be hit especially hard when extreme weather or a more isolated event results in damage and/or forces a temporary closure. Unfortunately, one-fourth of small businesses never reopen after a major disaster.² Companies with a thoughtful disaster plan and adequate insurance protection may be in a better position to avoid such a fate.

Crafting Coverage

A business owner policy (BOP) is a package that typically includes insurance (up to policy limits) for property damage, liability, and business interruption. Property insurance helps protect a company’s buildings and equipment against a specific list of perils, similar to the coverage offered in a standard homeowners policy.

Business interruption insurance covers lost profits and operating expenses that may continue while a business is closed because of a disaster. There is generally a 48- or 72-hour waiting period before coverage begins.

This type of insurance may apply only if there is physical damage to the structure or the property is inaccessible because of an Order of Civil Authority (and only if the order resulted from a covered peril). Consequently, a business that is shut down due to a power outage may not be covered unless an optional endorsement for “off-premises service interruption” is purchased at an additional cost.

Floods are usually excluded from BOPs, but coverage may be available from the government’s National Flood Insurance Program or some private insurers. Unfortunately, only about 20% of the businesses affected by Sandy had flood insurance.³ Earthquakes are also typically excluded from BOPs.

Poised to Recover

When forming your disaster plan, schedule annual insurance reviews to make sure your coverage is keeping up with company changes. Updating your policy is especially important if you have expanded or purchased new equipment. Try to keep an accurate business inventory and take photos of the premises and all your business property.

Store these and other financial records online so they can be accessed from a temporary location, if needed. Good documentation may speed up the claims process and help you reopen for business as soon as possible.

1, 3) Insurance Information Institute, 2012

2) The Wall Street Journal, October 21, 2012