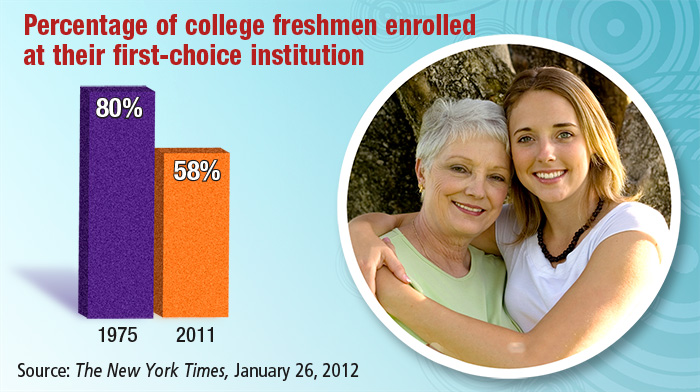

Would you be disappointed if your child or grandchild was not able to attend his or her “dream” college solely for financial reasons? If you aspire to help a student cover rising higher-education costs, it may be wise to start saving as early as possible.

Parents and other family members can contribute to state- and college-sponsored 529 plans that feature tax-deferred accumulation. Withdrawals are tax-free if used to pay qualified higher-education expenses. There are no income restrictions for participation, although each state sets a maximum annual contribution limit.

When 529 plan withdrawals are not used for qualified expenses, earnings may be subject to ordinary income tax plus a 10% federal income tax penalty. The tax implications of a 529 plan should be discussed with your legal and/or tax advisors because they can vary significantly from state to state. Most states offer their own Section 529 plans, which may provide advantages and benefits exclusively for their residents and taxpayers.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated.

Before investing in a 529 savings plan, please consider the investment objectives, risks, charges, and expenses carefully. The official disclosure statements and applicable prospectuses — which contain this and other information about the investment options, underlying investments, and investment company — can be obtained by contacting your financial professional. You should read these materials carefully before investing.